Banks must play fair as mortgage rates rise

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is the latest part of the FT’s Financial Literacy and Inclusion Campaign

The Bank of England has fired its big bazooka — and millions are worried about the hole this could blow in their household budgets.

Thursday’s decision to raise rates to 5 per cent will be painful for the rising numbers of borrowers rolling off fixed-rate mortgage deals.

This is especially the case for those on the lower rungs of the housing ladder who bought recently — perhaps during the stamp duty holiday two years ago — and have bigger loans to service.

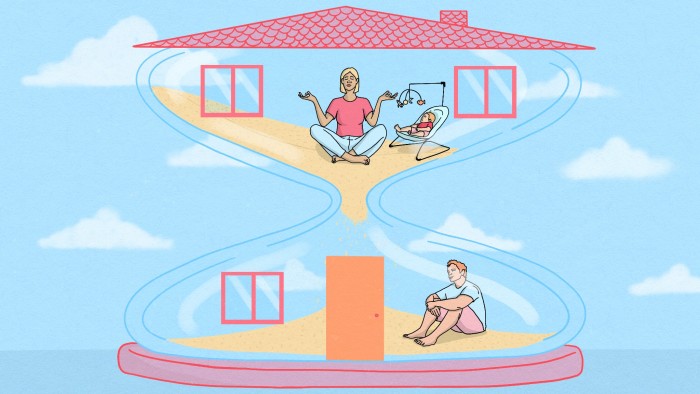

Having secured a home, these first-time buyers may well have started a family by now. With childcare costs eating up the bulk of their disposable income, finding hundreds of pounds extra every month is a grim prospect.

I have received anguished messages from Money Clinic podcast listeners in this predicament who worry they will no longer pass lenders’ affordability tests when the time comes to remortgage. So here’s my cut-out-and-keep “don’t panic” guide to navigating what’s to come.

First, stating the bleeding obvious, however scary this is, you must plan ahead. When fixes end, borrowers are shifted on to their lender’s SVR (standard variable rate) and most of these are 8 per cent and rising. This figure is commonly used in the “illustrative example” letters that lenders send out. Yet if you agree a new deal, you’ll be able to access lower rates.

What’s more, the vast majority of lenders have pledged to offer existing customers a new deal without undertaking further affordability checks. This is thanks to a deal brokered by regulators last December. So long as you are up to date with your mortgage payments, and are not extending the length of your mortgage or amount borrowed, this will be possible.

Brokers say the rates that banks have been offering to existing customers are competitive and not far off those offered to new customers. They can track down the best deals if you do switch lender, although striking any new loan agreement will require affordability tests.

Live Q&A: June 23, 12pm GMT

Do you have questions about UK mortgage rates, high inflation, and rising interest rates? Our consumer editor Claer Barrett will join Adrian Anderson, director of mortgage broker Anderson Harris, and Sarah Pennells, consumer finance specialist at Royal London to answer your questions. Click here

Assuming you can pass these and still have a few months until your current deal expires, switching lender could offer a bit more flexibility. A broker can help you lock into a fix with a new lender ahead of time, but switch to a better deal — without penalty — if one becomes available. This could be a useful insurance policy if rates on longer fixes do fall in coming months (well, we can dream).

Yet for many, the monthly repayments are still going to be unaffordable.

“Understandably, people are terrified that their house will be repossessed, but that is the last thing mortgage lenders want to do,” reassures Sara Williams, a former debt adviser, better known online as Debt Camel.

“Contacting your lender to discuss your options will not impact your credit score. However, if you’re really scared, talk to a debt adviser first so you’re prepared for the call.”

They can help you go through all of your income and expenses to work out a budget, and can also advise on reducing other unsecured debts such as credit cards. Williams recommends the free “Your Budget” tool on the National Debtline website, which usefully converts weekly and annual payments to a printable monthly budget.

“For the vast majority of people, your mortgage lender will have help to offer you, but if you know your budget first you can be more confident about talking to them,” she says.

According to UK Finance, the financial services trade body, the most commonly offered solution now is an arrangement under which borrowers are allowed to make lower monthly payments for a set period, with the arrears added to their loan. Having been done with your lender’s agreement, they won’t chase you for these debts — although it will affect your credit score.

Credit scores can be rebuilt in time, but people I’ve spoken to on radio phone-ins this week worry greatly about how this could affect their future refinancing options.

Under an agreement with lenders on Friday, customers will also be permitted to switch to an interest-only mortgage for six months, or extend the term of their mortgage to flatten out monthly repayments. Neither will require affordability checks, or affect people’s credit scores - although they will add to long-term borrowing costs.

The help lenders offer will depend on your individual circumstances, so the exact deals borrowers at different banks will be able to secure will vary. This is an area regulators need to watch very carefully.

For all the assurances about forbearance that lenders are making, it is vital that borrowers have rapid access to an independent arbitrator if they dispute their bank’s decision.

Why? Just look at the lottery that scam victims have faced in terms of how fraud reimbursement rules are applied by different banks. Some get their money back; others have to go through a lengthy complaints process involving the Financial Ombudsman before the banks pay up — and an alarmingly high number of cases are upheld.

When a potential house sale or repossession is hanging in the balance, speed is of the essence. Yes, there will be tough decisions ahead, but the public needs to have confidence that these will be fair decisions.

While the headlines this week have focused on homeowners, we cannot forget about the financial pressures on renters.

Nearly 2mn households renting privately rely on benefits to cover some of the costs, yet local housing allowance rates have been frozen since 2020. The IFS estimates this freeze will save the government £650mn in the current tax year, a shortfall funded by those on the lowest incomes.

Spiralling rents are sapping the finances of higher-earning tenants too. Some have given up saving for a housing deposit altogether. This week, it was revealed that under-40s saving into Lifetime Isa accounts incurred penalty charges of nearly £50mn by raiding their savings early. It’s understandable that the 25 per cent government bonus must be forfeited, but it’s sickening they lose a chunk of their own savings on top.

If you’re in the happier position of being able to use your savings to overpay your mortgage before your fixed rate expires, a final tip. You will have much more flexibility if you stash any cash in the highest interest rate savings account you can find, rather than pay it directly to your lender.

As the banks ramp up lending rates, there will be cries of moral hazard if they fail to increase savings rates too.

When the time comes, you could use this to pay off a chunk of the mortgage before striking your next deal, but crucially, you could still access the cash in an emergency. As the likelihood of a recession increases, I think this would be a wise move.

Claer Barrett is the FT’s consumer editor and the author of ‘What They Don’t Teach You About Money’. claer.barrett@ft.com Instagram @Claerb

This article was updated on Friday afternoon to reflect the new measures mortgage lenders will offer borrowers

Comments