Financial advisers seek guidance on recommending bitcoin ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Now that exchange traded funds holding actual bitcoin — rather than futures contracts — have finally been given the go-ahead, a new process has begun: winning over the due diligence experts used by client-facing financial advisers.

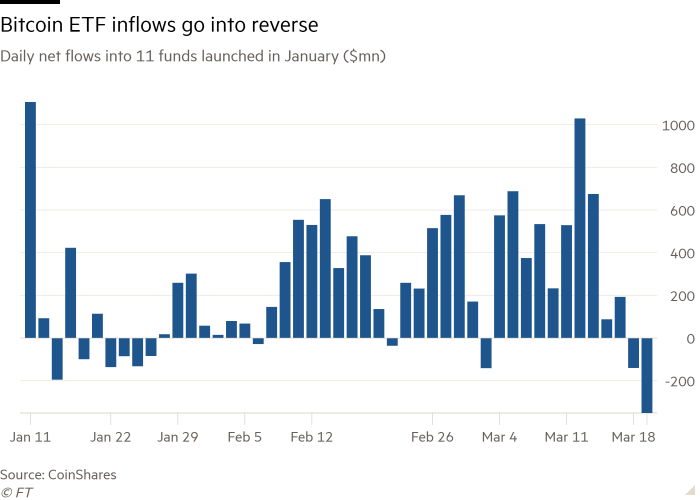

The first ten of these new ‘spot’ bitcoin ETFs have already made an impact, attracting inflows of more than $7bn, combined, in less than two months after their January launch — before a more recent reverse.

One analyst coined the term “Cointucky Derby” to describe how the new ETFs shot out of the gate once the Securities and Exchange Commission reluctantly fired its regulatory starting gun, early in the new year.

But most of the ETF providers attracting these inflows — even early winners such as BlackRock and Fidelity — have yet to make much money on their products, as they have cut fees for early investors to nothing, or nearly nothing. Higher fee levels are set to kick in several months down the line, or once an ETF reaches a certain asset value threshold — with the exception of Grayscale Investments’ bitcoin ETF, which maintains a hefty 1.5 per cent expense ratio.

However, a larger determinant of these products’ long-term profitability will be their ability to pass muster with the fund analysts and financial advisers who vet funds and add them to client portfolios.

Brooks Friederich, principal director of investment solutions strategy at Envestnet, says that advisers are looking to ‘gatekeepers’ like him for guidance. “I’ve said this loudly with advisers to get them ready: they’re going to be swarmed, and maybe already are, with all this product that’s sitting in these ETF wrappers,” he reports.

At a basic level, the ETF due diligence process has two major components: looking at the investment case for a fund’s assets; and then analysing its inner workings for soundness to ensure it does what it is supposed to do. Analysts typically take months over this before presenting their findings to the investment committees at advice firms, which can grant approval for advisers to recommend ETFs to their clientele.

This was once a relatively simple process when dealing with a low-cost passive ETF product from Vanguard, iShares and State Street Global Advisors. But Friederich says: “Now, there’s a lot of unique, innovative products in this ETF wrapper.”

Even so, Rich Kerr, an attorney who co-leads the digital assets team at law firm K&L Gates, is optimistic that the new crop of spot bitcoin ETFs might be easier to approve than expected. Already, several of the major broker-dealers have approved bitcoin ETFs for sale on their platforms — although Vanguard has, notably, declined to offer any of the products.

“This is not a complex derivative-type strategy, the risks of which are unknown,” Kerr argues. “You know they’re tracking the price of bitcoin and investing in bitcoin, and that is a really simple investment to understand.”

Many due diligence specialists want a mutual fund or ETF to have a lengthy performance record before they will consider putting it on a recommended list or a brokerage platform. But some bitcoin ETF issuers are confident they can gain due diligence approval without that, given the fact that similar funds had existed for some years before the SEC’s January approval of spot funds.

“Much of the friction of understanding bitcoin and doing the work on bitcoin asset managers was done in 2021,” reckons Steve Kurz, global head of asset management at Galaxy, referring to the private bitcoin funds that were launched years ago for select clients of firms such as Wells Fargo and JPMorgan. Galaxy has partnered with Invesco to launch a spot bitcoin ETF.

Kurz says that what remains in question is the operational half of the due diligence process. He and his team have fielded inquiries about how ETFs obtain and hold bitcoin, as well as how they create and redeem shares with cash.

But the conversations Kurz has had to date lead him to believe that most of the large platforms in the US could greenlight bitcoin ETFs by the end of this year.

“Those that have already embraced bitcoin, they’re moving from private fund to public fund and from unsolicited [purchase not suggested by an adviser] to solicited [advised or discretionary purchase],” Kurz says. “Those that didn’t get there are looking at it similarly, but they have a little bit of a hurdle because it’s the first time they’re actually getting bitcoin to their clients.”

Still, there’s a big difference between a bitcoin ETF being available on a brokerage platform and being recommended by a firm. For example, Charles Schwab already allows bitcoin-based ETFs to trade on its platform but a spokesperson says: “at the present time, we don’t have any spot bitcoin ETFs on our recommendable lists, but we’ll continue to evaluate the offerings.”

Friederich says he expects his team to take longer with bitcoin ETFs than they would with a more familiar product, underscoring how cryptocurrency still faces hurdles to being deemed “traditional” finance. “It’s a learning curve for us,” he admits. “We’re not digital currency experts.”

Comments