How Crispin Odey evaded sexual assault allegations for decades

Note: This story contains depictions of sexual assault and abuse.

For more than three decades, Crispin Odey has reigned over London’s hedge fund scene as an eccentric with a reputation for delivering enormous returns as well as devastating losses. Odey Asset Management, his firm, was once one of Europe’s largest hedge fund companies and Odey, the man, a character from a bygone era of finance. An imposing figure at over 6ft tall, he cultivated an image as an unapologetically posh gentleman rebel. This newspaper once described him as “a large puppy in a pinstripe suit”. He used his wealth and influence to boost the country’s Conservative party, back Brexit and cultivate friendships with former prime minister Boris Johnson, among others. Although Odey’s assets under management have fallen from their $13.3bn peak several years ago, he has maintained his reputation as one of London’s last hedge fund mavericks.

Thirteen women who have worked for Odey Asset Management or had social or professional dealings with its founder told the Financial Times that Odey abused or harassed them; eight alleged he sexually assaulted them. The incidents — which included masturbating on a female entrepreneur after a business meeting and forcing a friend’s hand on to his penis — occurred between 1998 and 2021. The FT has corroborated accounts of an abusive workplace culture through interviews with more than 40 former employees of Odey Asset Management at every level.

One Must-Read

This article was featured in the One Must-Read newsletter, where we recommend one remarkable story each weekday. Sign up for the newsletter here

This is not the first time Odey, 64, has faced serious misconduct accusations. In 2021, he defended himself against a sexual assault claim made by a female banker in British courts and won. Allegations in Bloomberg, The Sunday Times and a Tortoise Media podcast have done little to hurt his standing. UK regulators still consider Odey “fit and proper”, the standard senior management at financial firms must uphold, and he continues to be quoted in Britain’s most influential newspapers.

Two instances of sexual misconduct took place after his court case ended. The FT found that senior executives at the firm knew about his behaviour but took 16 years to launch a formal investigation into Odey’s conduct. In 2021, the company took previously unreported measures to rein Odey in — unsuccessfully. When the firm’s executive committee tried a second time, he moved with the sangfroid that made him a City legend and fired them.

A law firm representing Odey Asset Management declined to comment in detail on the allegations made by women in this article, citing confidentiality. It noted that the firm has anti-harassment and workplace relationship policies in place and that it “has, at all times, complied with all of its legal and regulatory obligations”. The statement added the average length of service by staff is 9.3 years, evidence of a “longstanding and ongoing positive culture and healthy working environment”. Reached briefly by phone, Odey said the allegations were “rubbish” and hung up. A week later, a law firm representing him said he “strenuously disputed” the allegations and claimed the FT had a “preordained agenda”.

Nine of the women who spoke to the FT have never told their stories publicly before. Most requested anonymity for fear of social, professional or financial retaliation. The women said they were speaking out because Odey continues to preside over a large, highly regarded company, where he wields power over young female employees. Their accounts paint a picture of a domineering executive holding court over a company culture that could be as intoxicating as it was toxic.

Robin Crispin William Odey established Odey Asset Management in 1991 on Upper Grosvenor Street in the heart of Mayfair, an exclusive pocket of London that is home to hedge funds, Michelin-starred restaurants, bespoke tailors and art galleries. He was the only son of a Yorkshire family that made its fortune in the tanning industry. By the time he graduated from Oxford university in 1980, his family’s finances were in tatters and he was forced to sell his ancestral home. He saw a chance to restore his fortune in banking and, in 1985, began working at Barings International, where he flourished. When Barings shifted its investment approach away from relying on individual star bankers, towards a more co-operative model in the late 1980s, Odey decided he “could not live” with the change, a former colleague said. Instead, he set off on his own. It was the dawn of an era in which soaring stock markets created vast fortunes for a growing number of hedge funds run by imperious managers. George Soros, the billionaire philanthropist, was one of Odey’s first investors.

“The big man”, as he was known to staff, set up shop in a discreet, five-storey town house that former employees said felt more like a home than a workplace, with carpets so plush staff could walk around without shoes. Odey arrived each day before markets opened at 8am, dressed in an expensive suit with pink or red braces. A gold bar lay on his desk, serving as a paperweight.

Despite the signifiers of wealth, he gave off a slightly dishevelled air, his light-brown hair flopping over thick black glasses. He could be intense; discussions with his investment team were highly charged, even volatile at times. In the afternoon, Odey tended to disappear for a lengthy lunch at one of his favourite Mayfair haunts: Scott’s, Corrigan’s or Le Gavroche. He often returned to the office looking even more rumpled, his cheeks rosy and his mood unpredictable.

The company’s early years were tumultuous. Odey’s flagship fund suffered heavy losses in the early 1990s after the US Federal Reserve unexpectedly raised interest rates. But his willingness to endure risk levels most financiers could not tolerate helped him recover. A fund manager, who described his former boss as a “big teddy bear” and “probably the smartest guy I have ever seen in the industry”, said that during a meeting in early 2007 Odey instructed his staff to start shorting British banks — betting their value would fall. The economy was still riding high, with little to indicate the coming crash. “I thought he was crazy, completely crazy,” the fund manager said. “It was an unbelievable call.” And one that paid off. Odey earned £28mn in 2008, after his firm made profits of £55mn. Assets under management grew to $5.25bn, up nearly tenfold from a decade earlier.

As Odey’s wealth surged, so did his involvement in politics. He started donating regularly to the Conservative party in 2007; his donations to date total more than £350,000, according to public records. He also gave large sums to the anti-immigration Ukip party and to Democracy Movement and Global Britain Limited, both anti-EU pressure groups. Odey’s generosity extended to MPs, including Johnson before he was prime minister, his brother Jo Johnson and former cabinet minister Jacob Rees-Mogg. Odey Asset Management once employed Kwasi Kwarteng, who was briefly chancellor last year.

Odey’s financial and political ties turned him into a symbol of British success in international high finance. He soon became as well known for his voracious appetite and old-school attire as he was for his punts on markets. Odey was increasingly cited in the national press, often pictured alongside his wife at the time, Nichola Pease. He married the prominent banker with dynastic ties to some of the City’s largest financial institutions in 1991; they have three adult children.

Odey Asset Management was structured as a partnership. Odey, the chief executive and majority owner with an estimated 75 per cent stake, was also the primary decision maker and his word tended to be final. “You are not allowed to step on his toes. It is his playpen, and he is going to call the shots,” said a former partner who worked there for more than a decade. As such, the office culture reflected the attitudes and interests of the company’s founder. Fund managers, Odey included, would leave gun cases behind the reception desk before swooping off early on a Thursday for a long weekend of grouse shooting. Dead pheasants were occasionally stored in the office fridge. Junior staff were sometimes sent on bizarre errands: to fetch cartridges from Purdey, gunmakers to the British royal family, or to haul a Persian rug across Mayfair.

Odey’s growing legend played to a nostalgia for an era in the City that had largely passed, during which you could get pickled at long lunches and still make a killing based solely on being cleverer than the next man. Several former employees likened Odey Asset Management to a boarding school, pupils jealously vying for attention from their mercurial headmaster. “You feel good when the Sun King is smiling on you and not so good when the gaze moves to someone else,” said a former fund manager. Another added: “It was abundantly obvious that there was one person to please in the room and that was Crispin. That was the way you got on, got ahead, got paid.”

While Odey was known for a disarming, boyish charm and his generosity, he also had a temper, more than a dozen former employees said. One referred to him as a “20-stone toddler”; several more used the same analogy to describe him. When angered, he pointed his fingers like a gun at the source of his displeasure and mimed pulling the trigger. One former employee said he dropped to the floor playing dead when Odey’s sights turned on him. Another pretended to lob a hand grenade back at his boss. But male colleagues were at times reduced to tears by Odey’s rage.

Odey was known for another predilection: hiring “earls and girls”. For many years, Odey Asset Management’s predominantly male workforce included a disproportionate number of Old Etonians and Old Harrovians, as well as employees with every title imaginable: dukes, barons, viscounts, marquises and earls. (Odey attended the elite boarding school Harrow.) Women were initially only hired to be receptionists or to fill secretarial positions. But as the firm grew, it added a small number of women to its investment team. Eventually, Odey opened a second office a five-minute walk away, on Upper Brook Street. The boss visited regularly and had the basement converted into an opulent dining room, with a wall dedicated to row after row of vintage wines.

There were splashes of modernity amid the old-world pomp, including a Grayson Perry print which hung on the wall of a partners’ meeting room. Perry, who created the artwork as a critique of the recklessness of the finance industry, once said it portrayed the “irrational beast that controls the market”. The image depicts a baby lying beneath a creature that is half bull, half bear, its oversized genitalia dangling above the infant’s head.

In 2003, Jae-Ann Maher moved to the UK from her native Australia and joined Odey Asset Management as a receptionist. She was 22 and far from home, without a support network. From the start, Odey paid her particular attention. “I probably seemed very vulnerable,” Maher said. “That was something Crispin gravitated towards quite quickly.” Soon after she started working for him, Odey offered to put her up in an apartment, telling her: “I can look after you.” She said she made it “very clear” she was not interested.

The office culture was “extremely sexist and male dominated”, according to Maher. Odey’s harassment included routinely asking about her bra size and past relationships. He made frequent unwanted physical contact, standing behind her when she was sitting at the front desk alone and massaging her shoulders, his hands often lingering around her bra straps or moving towards her breasts. To block him, she kept her arms pinned to her side. Sometimes, he kissed the top of her head. Revolted but fearful of losing her job, she tried to ignore what was happening.

Maher came to dread Odey’s approach. A grand staircase swept upwards from behind the reception desk towards the trading floors. Sitting at her desk, Maher could always hear when Odey was coming down the stairs, and her anxiety grew as his footsteps drew nearer. Maher said there were no channels for reporting his behaviour. She found the complicity among staff at every level of the firm who mostly accepted or encouraged Odey’s behaviour particularly disturbing. “Everybody knew it was happening but most of them turned a blind eye,” she said.

In July 2004, Maher was sorting the post when Odey instructed her to sit next to him. She declined, but another fund manager told her to comply and moved her chair next to their boss’s. Odey then began stroking her leg under the table. When she moved away, he laughed and told her she had to learn to enjoy it. Later that month, Maher experienced what she describes as “the worst physical incident” with Odey. She has blocked out parts of what happened because it was so traumatic but made a detailed written record of it in a statement she drafted for her lawyer later that year.

According to Maher’s recollection and the statement, which she shared with the FT, Odey called her into a meeting room on the pretext of discussing another partner’s conduct and started grabbing her and trying to hug and kiss her. At one point, he was on his knees with his arms around her. Then he put his hand under her shirt. She tried to leave, but he wouldn’t let her. To stop him from touching her breasts, she covered her chest with her hands. When he finally let Maher go, there was make-up all over his shirt from where he had pressed her face against him. She felt humiliated and disgusted.

The following month, Odey’s personal assistant informed Maher she was expected to attend a lunch with their boss at Le Gavroche. Maher was alarmed. To protect herself against further unwanted advances, she asked if another receptionist could join them. But throughout the meal, Odey was visibly irritated about the additional guest.

When she pointed out Le Gavroche’s famed cheese cart to the other receptionist, Odey erupted. He told Maher she should have addressed her comment to him and started ridiculing her, saying she lacked social skills. “He told me that I would never eat at such an expensive restaurant again or have the opportunity to dine there without him,” she wrote in the 2004 statement. “He also told me that he is the boss and at the top of the company, and I was only a receptionist and therefore he has the money and power, and I was nothing.” The more she tried to remain calm, the nastier he became, she recalled.

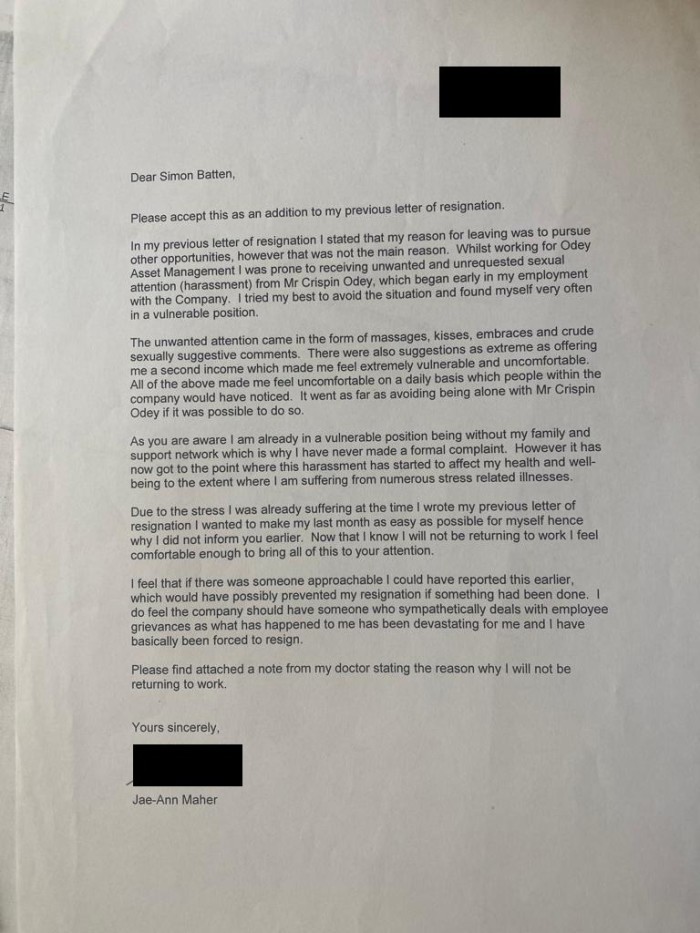

The next day, Maher resigned. At first, she glossed over the reasons for her departure. But after visiting her doctor who said she was not fit to see out her notice period, Maher faxed a second resignation letter to the firm with a sick note attached. The letter, addressed to then-CEO Simon Batten and sent on August 18 2004, explained why she was really leaving. It stated she was “prone to receiving unwanted and unrequested sexual attention from Mr Crispin Odey” in the form of “massages, kisses, embraces and crude sexually suggestive comments”.

Soon after, Maher’s lawyer outlined her demands to the company: a good reference, an apology and, to ensure no one else suffered as she had, for the firm to introduce formal procedures for reporting grievances and harassment. Maher wanted all staff to “receive appropriate training, including Mr Odey”. She also sought £15,000 in compensation.

Maher told the FT she went to a lawyer because she “was so outraged at the lack of process and the power [Odey] had to do whatever he wanted with no recourse”. In December 2004, she settled, receiving a generic employment reference and £7,500. There was no apology, and the signed agreement, seen by the FT, makes no reference to the requested grievance procedures or training. Maher said she was advised by her lawyer at the time that this was the best outcome she would achieve; she felt she had no alternative.

Now 41 and a mother of two, Maher lives overseas and works outside finance. She chose to go on the record to try to hold Odey and his firm to account. She is the only woman who felt confident enough to do so, in part because the social and professional risks of speaking out have lessened. Still, by participating in this article, she is breaking the terms of the agreement she signed. Maher decided that disclosing her experience is in the public interest. “I don’t want that world for my daughters,” she said. “I want to set a good example and create positive change.”

Odey Asset Management responded to questions from the FT via Duncan Lamont, a consultant at law firm Charles Russell Speechlys. Lamont said the firm has compulsory training on diversity, equity and inclusion for all staff, including partners. “It takes staff relations very seriously,” he said. The firm declined to state when the procedures were introduced.

As Bianca hurried towards Swan Walk, a pretty street lined by Georgian town houses in Chelsea, she felt nervous but excited. (Some of the names in this story have been changed.) It was March 2013, and she was on her way to meet Odey for the third time. Then in her late thirties, she had recently been introduced to him by a mutual acquaintance as a potential investor. In an email to Bianca, the acquaintance wrote: “If you play your cards right, he will fund your business.”

It wouldn’t have been the first time that Odey lent a helping hand to an acquaintance in financial need: over the course of his career Odey has supported Rees-Mogg’s investment boutique Somerset Capital, his good friend Jonathan Ruffer’s eponymous investment firm and his former colleague Freddie Lait’s Latitude Investment Management. He even backed an organic food business in west London in 2010, which sold an “Odey sausage” in homage.

Bianca had worked at several hedge funds, but striking out on her own put her in a precarious financial position. She had put everything she had into her new venture, an elite marketing service for hedge funds, and was living almost hand to mouth. To reduce expenses, she lived with a flatmate in Berkshire, just outside of London. Before her first meeting, she emailed a business contact about Odey: “I think he sounds wonderful, and I am really excited about his enthusiasm (and kindness).”

That meeting proved an anticlimax. She had heard Odey described as jolly and entertaining but, in person, he seemed distracted. As they said goodbye, though, his interest picked up. He told her he loved her ideas and wanted to meet again. Their second meeting took place a few weeks later in a small Italian restaurant in the World’s End area of Chelsea. The staff treated the financier like royalty but, again, his behaviour seemed off. He managed to name-drop powerful friends, including then-prime minister David Cameron, and to boast of sleeping with an acquaintance’s daughter, who was in her early twenties. He noted that he rewarded the young woman with expensive clothes.

Bianca said she found the conversation unsettling, but tried to take heart from his interest in her idea. Odey suggested they meet again, this time at his home. Bianca had been invited to a business meeting at a hedge fund mogul’s home before, and Odey suggested his wife, Nichola, would be there. “I thought, wow, how lucky am I? To be able to meet two people who might change my life,” Bianca said.

When the third meeting came around, she arrived at his town house on Swan Walk towards 8pm. Odey answered the door himself. Once inside, Bianca sat at a kitchen table while he poured two glasses of wine. She asked if Nichola was there. His wife had popped out, but the housekeeper was in, Odey replied. Bianca said she felt uneasy, but while they discussed her proposal Odey mentioned his wife from time to time, calming her nerves. This time, he was more solicitous and less distracted.

After an hour or so, Odey stood up and turned away from Bianca. When he turned back to face her, his erect penis was exposed. Shocked, she fled to the toilet. “I was sitting there going, oh my God, oh my God,” she said. “There was no subtlety or lead up. It was just there all of a sudden.” When she returned to the kitchen, Odey was fully clothed and acted as if nothing had happened.

Bianca felt trapped; she did not want to risk offending such a powerful man. Despite her alarm, she stayed to finish her pitch. “The next hour or so, I drank more and must have gone to the loo and cried about two or three times trying to psyche myself up,” she wrote several years later in a police statement. “I didn’t leave as I was so desperate for his business investment. I just did not know what to do, except try and ignore it.”

Bianca later realised she had missed the last train back to Berkshire. Odey said she could stay in his son’s bedroom, promising that “nothing will happen”. Again, she ignored her instincts and agreed to stay. She tried to keep him talking for as long as possible, in the vain hope that another member of the family would come home. Eventually, Odey offered to “tuck” her in, but she insisted that was not necessary. They walked up the stairs, pausing to admire a vast portrait of his wife. Bianca, stalling, asked as many questions about the painting as possible.

Once in the bedroom, Bianca curled up on the bed, fearful and tense. Odey came in and started touching her and removed her trousers. She pleaded with him to stop, but he continued. “I was so ashamed, and he was so big and intimidating I just lay there, saying we should not be doing this,” she wrote in the police statement. “He then started putting his fingers inside me and thrusting them hard and touching himself. I don’t remember much else, except I tried to fake something so it would all be over. But I couldn’t, so I started crying, softly at first, as I didn’t want to get him angry. And then I couldn’t control it and started sobbing and sobbing and putting my hands over my face.”

After a few minutes, Odey got up and left. Bianca — who described the assault as “revolting and horrific” — spent the night unable to sleep, on high alert with each creak of the house. She left early the following morning.

Like Maher, Bianca has never spoken about her experience publicly before. She said the assault left her consumed by shame, anger and fear. Her self-confidence was shattered by what she saw as poor decision-making. Bianca set up more business meetings with potential investors, only to sabotage them just before they took place. Increasingly desperate and angry, she emailed Odey in April 2013 requesting an investment. She included a veiled threat: if she did not get her business off the ground, she was considering writing a book about the hedge fund world. Odey’s secretary responded: “I’m afraid he does not wish to invest in the company. He sends his regrets and wishes you well.”

A few days later, on May 1, £10,000 was deposited directly into Bianca’s business account. The sender was listed as RCW Odey.

The past decade has been volatile for Odey Asset Management. The firm’s assets under management peaked at $13.3bn in 2015, but have since plummeted on the back of violent swings in the performance of Odey’s flagship fund. After hefty losses in the three years to the end of 2017, he recovered in 2018 with a positive return of 53 per cent. His performance nosedived again the following two years.

The rollercoaster proved to be too much for many clients, a mix of pension funds, charities, aristocrats, staff, friends and family of the financier. In 2017, Jersey’s influential Public Employees Pension Fund pulled £85mn out, citing a “period of sustained underperformance”. Concerns grew among smaller investors too. The head of a charity, which invested with Odey for nearly two decades, said it sold out in 2019 because the financier’s high-risk approach had become intolerable. “He’s a very, very, clever man, but he’s a gambler,” he told the FT.

Odey has since returned to form, posting positive returns of 54 per cent in 2021 and with his flagship fund finishing 2022 up 152 per cent. Colleagues admire his chutzpah. “Crispin could be like a boxer lying on the canvas, bleeding from every orifice, and then — wow, he’s up again,” Nick Carn, a former partner, said. Another added: “That man is a master risk taker. That is what he is, more than a genius.” James Wheeler, a finance executive and former employee, said: “A lot of the things he’s done are extraordinary, and he is an incredible person.”

Still, six former insiders said they chose not to place money in Odey’s funds, despite being offered preferential terms. “I could see the way they would take such big bets, and I was not willing to . . . lose 50 per cent,” said one former employee. Another said simply that he “was not a big believer in funds”. One ex-employee said he opted to invest in funds run by James Hanbury — a highly respected fund manager at the firm who is widely seen as Odey’s eventual successor — over those of the founder. Hanbury’s funds were “less volatile”, he explained. “There was no way I was giving Crispin any money of mine,” said a former portfolio manager. “You wouldn’t let him run a sweet shop because he’d eat the entire shop.”

For many women who worked for Odey, the suggestion he lacked self-control rings painfully true. Several said Odey engineered situations to corner female staff. Jane, a former junior employee, recalled three occasions on which she found herself alone with him. In early 2017, he surprised her in a small meeting room and said: “We are going to fuck.” Taken aback, she tried to laugh off the comment.

Two more disturbing incidents followed when Jane shared cars with Odey after social events. On the first occasion, Odey began forcefully massaging Jane’s thigh. She inched away from him, but he moved his hand higher up her leg. She did not push him away because she was frightened it would provoke a more invasive assault. “I remember thinking, ‘Oh God, he could do anything to me right now.’” She said the groping continued for around half an hour, but “felt like a lifetime”. On another occasion, Jane was alone in a taxi with Odey when he began stroking her chest and then slipped his fingers under her dress to fondle her breast. Frozen, she tried to ignore what was happening.

Jane said these incidents made her feel “brainwashed” about how men and women should behave towards each other in the workplace. Like many of the other women, she feared that if she hadn’t left the firm, Odey’s behaviour would have been completely “normalised”.

On the upper floors of Odey Asset Management’s offices, drop ceilings that hid wiring made some of the rooms feel poky. But the reception retained the building’s original splendour: high ceilings, wood-panelled doors, marble-wash paint and the grand staircase. All of it bathed in a warm yellow glow welcoming people in. Odey found many of his targets there.

Including Maher, who brought the 2004 legal complaint against Odey, the FT spoke to 11 former receptionists who worked at his firm between 2003 and 2021. Ten of them have never spoken to the press before. All but two alleged experiencing abusive behaviour by Odey. The company’s receptionists tended to be young and inexperienced. Several joined fresh out of university, drawn by high salaries of up to £30,000 and bonuses that, in good years, nearly doubled their pay.

A key prerequisite was that they were attractive. The job consisted of the usual: greeting visitors, organising meetings, making hot drinks. Tea and coffee were served in mugs made by ceramicist Emma Bridgewater. Odey took one gold Nespresso capsule and lashings of full-fat milk.

Many of the women recalled being told soon after starting that Odey was “eccentric” and “flamboyant”, coded warnings. It was common for colleagues to advise female starters, in any role, to avoid taking the small office lift alone with him. A marketing assistant who worked there in the early 2010s said she was warned in her first week. “I remember it being very early on, like, ‘Here are the loos. Here’s your password. Don’t use the lift,’” she said. As a result, the so-called “Odey Girls” gained a reputation, she said, for having good legs because they “always took the stairs”.

Odey could be charismatic, some of the women recalled. But his questions quickly turned inappropriate. He asked about their sex lives and commented on their appearance, telling women their “legs look incredible in that” or saying “I’d love to see you in that” if he caught them browsing clothes online. He repeatedly offered to take them for lunch, dinner and shopping. The marketing assistant said Peter Martin, who was then her boss and is now the firm’s chief executive, explicitly told her not to agree to any shopping trips. “You were just told to avoid that situation,” she said. Odey Asset Management’s statement claimed this was “not a reflection of the firm’s culture”.

Over time, Odey’s verbal harassment turned physical. Unwanted massages were part of his “everyday behaviour”, the receptionists said. “You’d tell him to stop, but you can’t just slap him off,” said a woman who started in 2010. Another, who worked there in 2020, said that when she tried to pull away by leaning forward in her chair, he forcefully pulled her back.

Receptionists said they were subjected to prolonged, invasive hugs, during which Odey nestled his mouth in the nape of their necks, pulled them inappropriately close or kissed them on the forehead. On one occasion when he tried to kiss a receptionist, she turned her face. Odey, she recalled, stuck his tongue in her ear.

The harassment was particularly bad in the afternoon when Odey returned from lunch, cheeks flushed and brow sweaty. When the receptionists saw him walking in the front door, or heard him panting as he descended the stairs, they tensed up. Many of them learnt to avoid Odey by ducking into the storage room or toilets or busying themselves in the kitchenette when they heard him approaching. They developed a nickname for their boss: the octopus.

In June 2017, Emily met with Odey to discuss some work. From the start, the receptionist said he had “no interest” in talking business. Instead, he complimented her clothes. “I like that shirt on you,” he told her. Suddenly, he slipped his hand inside her shirt and cupped her breast for several seconds. “Long enough [for his hand] to move around a bit and for me to just be thinking, oh my God, what is actually happening?”

In shock, Emily tried to continue the meeting. “I was completely stunned. I didn’t feel like I could scream,” she said, adding that she had never thought Odey’s inappropriate behaviour would “cross the line” into sexual assault. “I was suddenly just another trapped girl in the office with Crispin Odey.”

Later that year, she and Odey were talking in a meeting room where he tended to store his shooting equipment. As she left, he put his hands on her waist and pulled her back inside. “No, Crispin!” she shouted. Grabbing on to the doorframe, she yanked herself free. She said her fingernails left scratches on the wooden architrave. Emily emerged, shaken, into the hallway where she saw one of the fund managers. He said nothing. The experiences lowered her self-esteem and made her feel “totally cheated”, she said. She left the firm soon after.

Many of the women who worked on reception went on to hold other roles in the company. Several remain close friends with one another. Most are adamant that everyone — from junior staff to senior partners — knew how vulnerable they were to unwanted attention from Odey. “I think you’d have to have been under a rock if you didn’t,” said one. “Literally under a rock.”

By 2020, Odey and his wife had an estimated fortune of £825mn, and they divided their time between their Chelsea town house and Eastbach Court. Their historic, Grade II-listed mansion in Gloucestershire had made headlines years earlier when the couple sought to build a Palladian-style chicken coop at an estimated cost of £150,000. The tabloids dubbed it “Cluckingham Palace”.

It was also the year that accusations against the financier picked up pace. In July 2020, the Crown Prosecution Service charged Odey on one count of indecent assault in relation to an allegation from 1998. The stakes were high: the maximum sentence for sexual assault in the UK is 10 years in prison, and a guilty verdict could have resulted in a lifetime ban from managing client money.

One month later, a lawyer representing a former receptionist not involved in the case approached the company alleging assault and harassment by Odey. Olivia, who worked at the firm for about a year starting in 2019, told the FT she was asked to sit on Odey’s lap in the reception area when no one else was around and that he fondled her breasts over her blouse in the office twice. She said he frequently gave her long uncomfortable hugs, held her around the waist and gave her unwanted massages. He also commented on her appearance.

In the summer of 2019, Odey took Olivia to lunch at La Petite Maison, where she said he refilled her glass repeatedly until she was drunk. He then asked her to come to the Connaught Hotel to show off his massaging skills. She talked her way out of it by reminding him she needed to relieve her colleague on reception.

In January 2020, Odey again took her to lunch, this time at Dickie’s Bar, the private dining room in Corrigan’s Mayfair, where he rested his hand on her thigh and held on to her waist while they shared two bottles of wine. At one point, he kissed her on the lips. She said she let him at first, but then turned away. During lunch, he invited her to the final shoot of the season at Eastbach Court. She accepted, but the idea of actually going caused her huge anxiety. “I knew what he wanted and what I was expected to do,” she said in the complaint submitted by her lawyer and seen by the FT.

After lunch, Odey sent her a flurry of effusive text messages; Olivia tried to respond politely.

Odey:

“That was lovely”

“Wish it was all afternoon and in bed xxx”

Olivia:

“Such a wonderful lunch x”

“Thank you again x”

“All okay for next week too x”

Odey:

“Yes! I can’t wait to have you! Xxx”

“You are so delicious! Wonderful to be with. Xxx”

She later excused herself from attending the shoot. The stress of her work environment took a heavy toll, and Olivia began abusing alcohol and became depressed. “I felt like I was taken for granted. Worthless in a way,” she said. “I just felt so dirty.” She said she felt unable to report Odey’s behaviour internally because one of the HR managers was his former personal assistant. Olivia left the firm in February 2020, but Odey continued to message her.

By September 2020, Odey Asset Management started a formal investigation into the founder’s conduct, carried out by its in-house legal team and its longstanding external law firm, Simmons & Simmons. Only three of the 11 receptionists in this article said they were contacted in relation to the investigation. One said she was called by an Odey Asset Management lawyer but did not trust her claims of confidentiality. “I just lied because I knew it was going to go straight back to Crispin,” she said. Simmons & Simmons declined to comment.

Another former receptionist who had been verbally and physically harassed by Odey was contacted by RMS, the temping agency that placed her at the firm. She was asked to fill out a survey about Odey Asset Management’s corporate culture. When she read an introduction in which the company claimed to strive for a workplace “that does not tolerate inappropriate sexual conduct”, she refused to fill it out. Instead, she told RMS it needed to stop sending young women to work there. RMS declined to comment.

In November 2020, with the court case looming, Odey stepped down as co-chief executive, although he retained majority voting rights and majority ownership. He continued to run five of its largest funds. That month the company established a new subsidiary, Brook Asset Management. Almost half of its funds, including those run by partners James Hanbury and Oliver Kelton, were later rebranded under the Brook name. It was a hedge against the potential fallout of Odey losing in court, but also reflected a trend under way for many years in the City of London for financial services firms to reduce their reliance on single stars.

Simmons & Simmons’ internal investigation ended in late-January 2021, and the firm’s executive committee — which, at the time, included chairman David Fletcher, head of research Massey Roborough, chief executive Timothy Pearey, as well as Hanbury — held a disciplinary meeting with their founder. The report concluded that Odey had at times behaved inappropriately with female staff, and he was given a “final written warning” by the committee. The reprimand — which has never been reported before — came with an extraordinary set of rules: Odey was no longer permitted to communicate with female staff about non-work matters, invite female staff to lunch or engage in unwanted touching.

The executive committee also gave the Financial Conduct Authority (FCA), Britain’s financial watchdog, a copy of the report and told the regulator it had decided to keep Odey on as he appeared embarrassed and remorseful. Financial services firms have an obligation to keep the regulator informed of disciplinary action taken against senior staff.

The court case began in February 2021. Despite the Crown Prosecution Service pushing for a jury trial, Odey’s legal team successfully argued it should be heard by a magistrate. Bianca, and a second woman who told The Sunday Times she was groped by Odey in a restaurant in 2008, separately contacted the police before the trial to provide supporting statements for the complainant. They were both told they would need to press their own charges for their allegations to be taken into account.

Throughout the three-day trial, Odey was flanked by his wife, Nichola, who was often pictured hand in hand with the financier. Both sides agreed that Odey and the complainant met at his home in Swan Walk in 1998 when his wife, who was pregnant with their third child, was away. (They separated shortly after the trial ended.)

From there their accounts differed. The complainant said she was groped by Odey who put his hand up her skirt and on her breast in an “octopussy-type manoeuvre”. Odey said he merely propositioned the complainant after suggesting the evening might end up “in bed”, adding: “She seemed very keen. I probably misread the signals a bit.”

On March 11, Judge Nicholas Rimmer found Odey not guilty. He told the financier he could leave the courtroom with his “good character intact” and congratulated him on reaching his sixties “without a stain on your character”. He was also highly critical of the complainant. Judge Rimmer said she displayed a “vivid imagination” and an “apparent desire for publicity”. He said he found Odey’s account “credible” but the complainant’s “riddled with troubling inconsistencies”. These included the season, time of day, what words were spoken at his house and whether it was light or dark outside.

Rimmer’s comments have since drawn criticism from women’s rights campaigners for potentially deterring other future complainants from coming forward. (The judicial press office said judges were unable to comment outside court on cases they have heard.) Four of the women interviewed in this piece said the judge’s comments contributed to their apprehension about formally reporting Odey’s conduct. One, who agonised for months about contributing to this article, said: “You don’t win against Crispin. All you’ll do is hurt yourself.”

Odey had seemed cowed in the months leading to the trial. After winning, he returned to his usual form, his voice booming across the office. His mistreatment of women also resumed; Odey behaved inappropriately towards two women in the months after his acquittal, lunging at one and sexually assaulting the other.

The first incident, previously unreported, took place in September 2021 after Odey took a female receptionist out to lunch and promised to help her career, according to three people with knowledge of what happened. Not long after, the woman was asked to return to Odey Asset Management by her temping agency, RMS, and she reported what had occurred. The agency informed Odey Asset Management, which triggered another showdown between Odey and his executive committee.

The committee started a second investigation into its founder in October 2021, according to former insiders and company documents reviewed by the FT. It concluded that Odey had potentially breached his written warning, the staff handbook and the FCA’s fitness and propriety guidelines. A second disciplinary hearing was scheduled for December 2021, but Odey delayed. Then, the financier decided to sack his executive committee instead, emailing partners on Christmas Eve claiming the committee had received bad legal advice and was driving the firm towards destruction.

A slew of senior departures followed, including executive committee members Pearey and Roborough, as well as chief operating officer Tom Richards, emerging markets fund manager Rob Marshall-Lee, technology specialist Simon Schafer, macro fund manager Tim Bond and institutional business head Jos Trusted. In all, they represented more than a third of the firm’s partners.

Louise was unaware of the chaos engulfing the company when she got to know Odey. The mother-of-three was first introduced to him in the autumn of 2021 after a mutual friend realised they shared legal advisers. (Odey’s legal team during the sexual assault trial was advising Louise on an unrelated matter.) That led to a dinner party invitation to Odey’s London home in November, co-hosted by his girlfriend, Diana Vitkova. (They married in 2022.)

Throughout the dinner, Odey appeared welcoming and generous, offering Louise thoughtful advice. Louise, then 50, was grateful when Odey checked in on her in the weeks that followed for updates on her case. “He was very jolly and very friendly and could not have been nicer,” she said.

Then came the invitation to Eastbach Court, which happened to fall on her birthday. She accepted. Until now, Louise has never shared the full account of what happened next.

On a Thursday evening early that December, around 14 guests settled in the dining room for a catered three-course meal of hearty English fare, washed down with one of Odey’s favourite wines, Château Figeac. The mood was buoyant and carefree. At the end of the meal, Odey called Louise into the small sitting room next door for a tête-à-tête about her case.

Sitting adjacent to each other on armchairs next to a crackling fire, she updated him, then stood up to leave. As she walked past his chair, he grabbed her, pulled her on to his lap, forced his tongue into her mouth and groped her breasts by slipping his hand inside the lapel of her dress. She pushed him away and asked: “Crispin, what are you doing?”

Instead of answering, he stood up and grabbed her again, crushed her body forcefully against his, pushed his tongue into her mouth and took her hand by the wrist and clamped it to his erect penis. He was dripping with sweat. “This is how excited you make me feel,” he said.

Disgusted, Louise managed to push him off her and asked: “What the fuck are you doing?”

Then she left the room and rejoined the others, who had moved to the drawing room for coffee. She spent the rest of the evening with the younger members of the party in an attempt to stay safe. Although she appeared to join in, she was in a state of shock. “It came out of nowhere, literally out of nowhere,” she said of the attack. “There was no flirting. It was disgusting. He is a revolting, sweating mass.” At midnight, the remaining group toasted her 51st birthday.

The following day, Odey behaved sheepishly towards her and barely said a word. She kept her distance. When a taxi arrived to collect her, Louise breathed a sigh of relief.

But the incident weighed heavily on her in the weeks that followed. Odey, meanwhile, had stopped checking in on the progress of her legal case. After a couple of months, she started to confide first in their shared lawyer and then with a small number of close friends and associates about what had happened.

As the months went by, she grew angrier about the assault. On August 1 2022, she sent Odey a WhatsApp message. He agreed to meet her alone three days later at her family office in central London.

In a formal meeting room, over the course of 40 minutes, she confronted him about the December assault. Initially, he denied having any recollection of it. Then, when pressed, he said: “I remember trying to kiss you”, adding that he was “probably very drunk”.

She corrected him, insisting that he had violently groped her. He responded: “I didn’t realise that I came on so strongly . . . you said ‘no’ and I stopped.” Echoing his defence at the trial a year earlier, he later claimed: “I misread the signals.” “There were no signals to misread,” she countered. Towards the end of their conversation, he went one step further towards admitting the assault: “I basically did make a play . . . and I was probably too forceful.”

Earlier this year, Odey joined his remaining colleagues at the JW Marriott Grosvenor House in Mayfair for the hedge fund world’s equivalent of the Oscars. The black-tie gala gathered the City’s financial elite, who vied to beat competitors for awards in categories such as Equity Market Neutral & Quantitative Strategies, Event Driven & Distressed and the coveted Management Firm of the Year. Odey Asset Management won firm of the year, beating seven rivals. The awards are based on financial performance, but they confer industry-wide recognition and celebration on winners. By then, eight women had reported Odey’s behaviour to the press or police.

For some of the 13 women who spoke to the FT, Odey’s continued public rehabilitation has highlighted the limitations of the #MeToo movement. “Without standing up to him, he will do it again and continue doing it,” Louise said. “The number of known assaults is large enough now that we are able to validate each other’s stories and face him with the confidence needed to stop his vile behaviour continuing.”

Madison Marriage is the FT’s special investigations editor, Antonia Cundy is an FT special investigations reporter, and Paul Caruana Galizia is an editor and reporter with Tortoise Media

Follow @FTMag on Twitter to find out about our latest stories first

If you have insight into the issues raised in this article, please contact investigations@ft.com. We want to hear from you

Paul Caruana Galizia’s podcast at Tortoise Media can be found here

Letters in response to this article:

An employment lawyer’s take on the Odey abuse story / From James Hockin, Senior Associate, Withers, London EC4, UK

Comments