‘It’s not going to be normal by September’: investors take stock as Delta spreads

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

As revellers returned to nightclubs at just one minute past midnight to celebrate the lifting of social restrictions in England on Monday, investors were less jubilant.

Instead, they watched as a stock market sell-off unfolded around the world, sending down many of the sectors that had propelled global equities higher earlier this year, some of them into correction territory — 10 per cent below their peaks.

England’s reopening added to some investors’ fears about rising cases of the Delta coronavirus variant. Europe’s Stoxx 600 index suffered its worst trading session of the year. In the US, where Delta is also spreading, the S&P 500 fell 1.6 per cent.

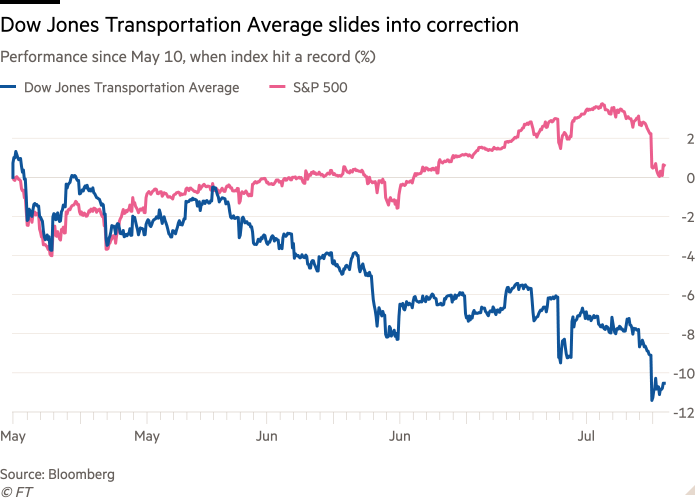

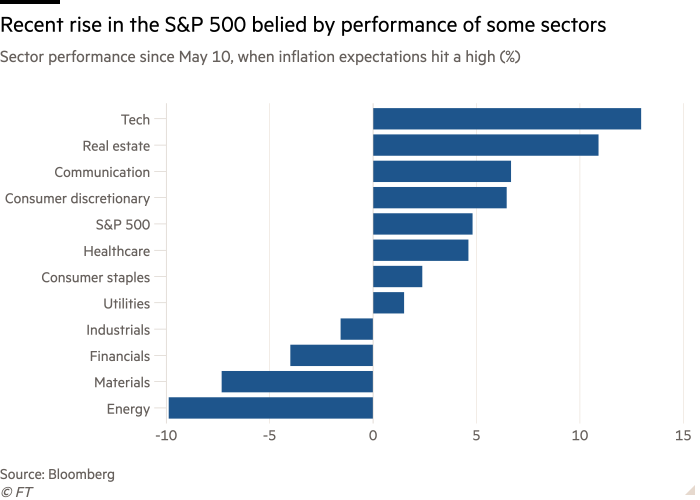

The seemingly relentless moves upward in the S&P 500 and other equity indices in recent weeks had belied turbulence bubbling just beneath the surface. Euphoria created by the vaccine rollouts this year has been subsiding, replaced by creeping concerns about the durability of the economic recovery.

“This virus [variant] is spreading rapidly. There has been a collective eye opening that this could delay things,” said Alex Veroude, chief investment officer for North America at Insight Investment.

“A lot of people had hopes we would be back to normal in September. It is not going to be normal in September. Is it going to be that bad in September? No, but it’s not going to be normal.”

The losses have mainly been concentrated in cyclical sectors that ebb and flow with changes in the broader economy. These industries had been the primary beneficiaries of the reopening trade, but that trade has started to unravel.

The Dow Jones Transportation Average, for example, which includes economic bellwethers such as shipping behemoth FedEx and railroad operator Kansas City Southern, slid into a technical correction on Friday last week. The big airlines in the index have fared even worse, falling into a bear market, defined as a decline of more than 20 per cent from their high.

Other areas closely tied to the US expansion have also been hard hit. Companies in the materials sector are down more than 11 per cent from a recent peak, with chemicals manufacturer Dow declining 19 per cent over the period. Energy stocks suffered a 4 per cent fall on Monday, the sixth straight day of losses.

The Russell 2000 index might have been a canary in the coal mine. It measures small and midsized companies, which tend to be particularly sensitive to changes in the US growth rate, and investors began to sour on those not weeks but months ago. It hit an all-time high in March and has been treading water since. Its 1.5 per cent decline on Monday brought losses from that peak to just below 10 per cent.

Since investor inflation expectations peaked in mid-May, more than half of the companies in the S&P 500 have fallen in value and 16 per cent are down more than 10 per cent. In the wider Russell 3000 — the 1,000 largest companies plus the Russell 2000 — at least 24 per cent of its constituents were in correction territory on Monday.

Strategists at Morgan Stanley warned on Monday that the speed of the rebound in economic activity in the US was unsustainable, and they recommended that clients took a more defensive approach to investing.

“There is little doubt pent-up demand exists for things like dining out, live entertainment and travel,” said Morgan Stanley’s Mike Wilson, but after splurging on cars, furniture and home improvements, there is less of a need for consumers to repeat those purchases. “It’s . . . clear there was a massive pull forward of demand.”

Investors have moved to hedge themselves against further equity market declines, buying put options that would pay off if stocks fall. The “put-call ratio”, which measures the number of put contracts purchased compared with the number of call options bought on a given day, on Monday hit the highest level since mid-May.

“What’s going on today is about this Delta variant and a scare which is completely understandable given cases are up in all 50 states,” said David Kelly, a strategist with JPMorgan Asset Management.

Investors have sought out the relative safety of US Treasury bonds, pushing yields on benchmark 10-year notes below 1.2 per cent on Monday, the lowest since February. Real yields, which strip out the effect inflation will have on returns, dropped as low as minus 1.12 per cent for the 10-year Treasury, the lowest since January.

Both data points were seized on by bears as harbingers of an economy cooling fast, as was the flattening yield curve: the gap between yields on long- and short-term government debt is also at its narrowest since early February.

The flattening curve has dimmed investor enthusiasm for the profitability of the banks, based on the crude thesis that it narrows the gap between what they pay to bring in cash and what they can make from lending it out.

A slower than expected economy, meanwhile, bodes ill for demand for borrowing among their customers. Lacklustre loan growth was a feature of second-quarter earnings from the sector last week.

As a result, US bank stocks have fallen 14 per cent from a June high. Shares of Bank of America have slid 15 per cent from their recent peak, while Citigroup is off 19 per cent.

Mike Lewis, head of US equities cash trading at Barclays, said that while he expected the drop in the stock market to be shortlived, investors were no longer baking in a powerful V-shaped recovery.

“It is clear investors are thinking the recovery may take a little bit longer and the reopening trade may not be as attractive.”

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday

Comments